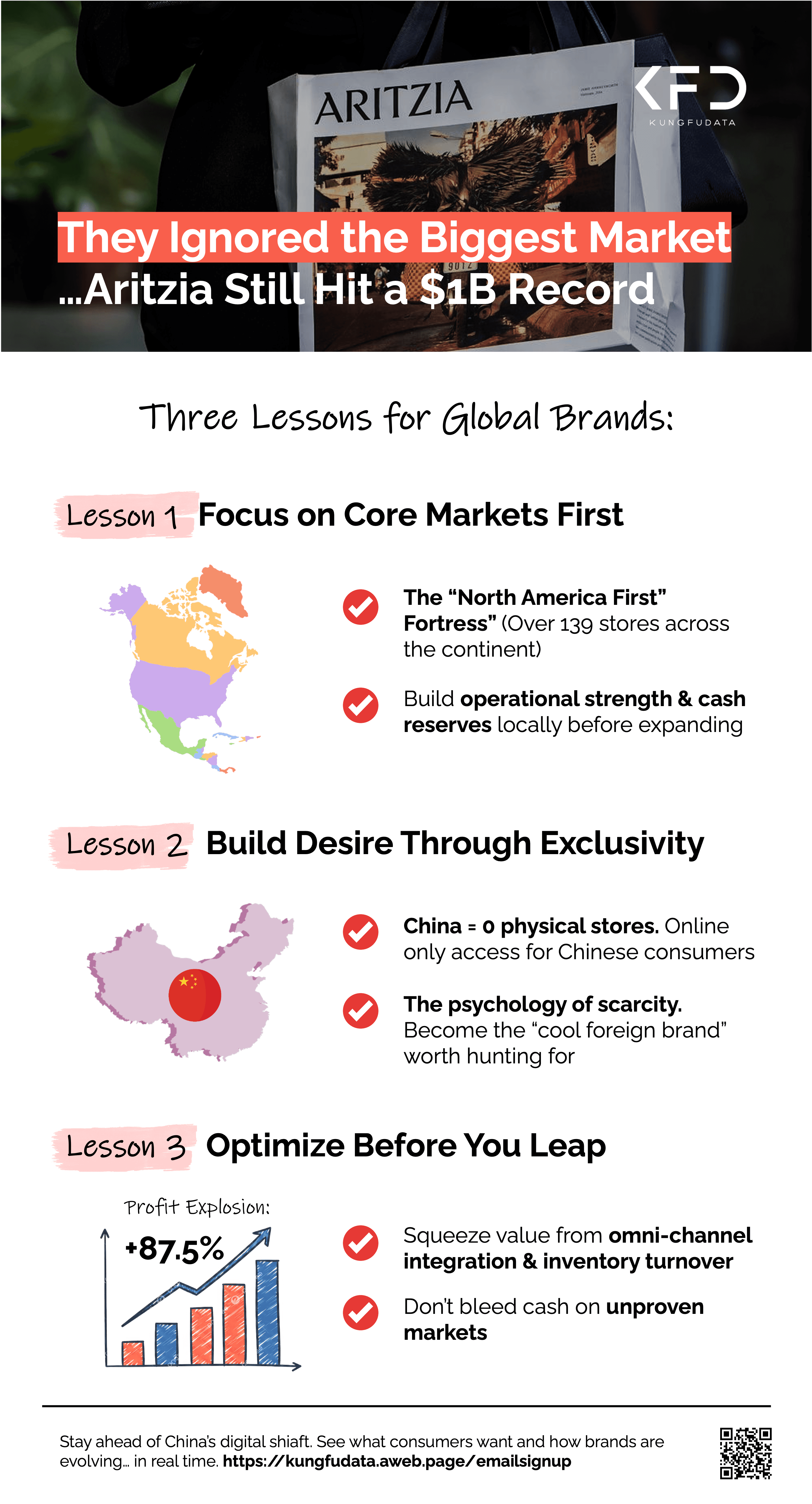

Aritzia Just Smashed a $1 Billion Record (And They Did It By Ignoring the Biggest Market in the World)

If you thought your obsession with the Super Puff™ was a solitary affair, think again. The Canadian cool-girl brand Aritzia just dropped their Q3 earnings, and the numbers are honestly rude.

For the first time in history, Aritzia hit $1.04 billion in revenue in a single quarter. That is a massive 42.8% jump from last year. And profits? They didn’t just grow; they exploded, shooting up 87.5%.

But here is the part that should make every Brand Manager sweating over their APAC strategy stop and take notes: Aritzia achieved world domination without opening a single brick-and-mortar store in mainland China.

Here is why this matters for brands trying to crack the global code.

1. The "North America First" Fortress

While competitors scrambled to open heavy-investment flagships in Shanghai and Chengdu, Aritzia doubled down on its backyard. They now have ~139 boutiques, with more than half in the US.

The Lesson: You don't need to be everywhere to make money. By perfecting their operational leverage and "everyday luxury" status in North America first, Aritzia built a cash-rich war chest. They aren't expanding out of desperation; they are expanding out of strength.

2. The Psychology of Scarcity

Check Aritzia’s official store map. North America? Covered. China? Blank. Currently, Chinese consumers can only buy via the international website.

This sounds like a mistake, but it’s actually a masterclass in brand desire. By not flooding the Chinese market with stores before the brand heat is at boiling point, Aritzia maintains an aura of exclusivity. They are the "cool foreign brand" you have to hunt for, not the one on every street corner.

3. Efficiency is Sexier Than Expansion

The wildest stat from this report isn’t the revenue… it’s the profit. Aritzia’s net income grew twice as fast as their sales. Why? Because they aren't bleeding cash on unproven international territories. They are squeezing every drop of value out of their omnichannel integration and inventory turnover.

The Takeaway for Brands: If you are eyeing the Chinese market, look at Aritzia. You don't always need to rush the gate. Build a product so undeniable that people will pay for international shipping. Build a financial engine so strong that when you do finally enter China, you can afford to do it on your own terms, not because you need the cash flow to survive.

The Bottom Line: Aritzia forecasts continued double-digit growth for the rest of the year. They are proof that in 2026, the best way to go global might just be to master staying local first.

Aritzia-Inc-Q3-2026-Investor-Presentation.pdf