Luxury Is Losing Ground. Sportswear Is Taking Over.

This isn’t just about who gets the best retail location anymore.

It’s about who defines “premium” in China now.

Walk through China’s top shopping districts in 2025 and you’ll notice something quietly radical happening. Traditional luxury brands are pulling back. High-end sportswear brands are moving in.

And that shift tells us more about China’s evolving high-end consumer than any earnings call ever could.

When Luxury Steps Back, Sportswear Steps In

Retail never hides the truth. The biggest brands move first.

Since the second half of 2024, top luxury houses. With the notable exception of Hermès. Have been closing stores across mainland China. Louis Vuitton exited its Shenyang Zhuozhan location. Dior pulled out of Dalian Times Square. Gucci followed with closures at Shanghai New World Daimaru and Réel Mall, sparking industry-wide debate.

These weren’t marginal locations. They were core city, prime retail positions. And those exits happened well before financial reports fully reflected the pressure luxury is under.

At the same time, something unexpected was happening. Professional sportswear brands weren’t slowing down. They were upgrading.

Instead of retreating, brands rooted in performance and function were opening larger, higher-spec flagship stores in China’s most prestigious shopping districts. Quietly becoming the new anchors of premium retail.

Why Sportswear Is Proving More Resilient Than Luxury

The difference comes down to usage and loyalty.

Luxury relies heavily on symbolic value. Sportswear relies on frequency. High-performance apparel is used weekly, sometimes daily. That drives repeat purchases, multi-season product demand, and strong community attachment.

Add in sports-specific ecosystems. Skiing, golf, running. And you get something luxury struggles to replicate. Built-in social networks and long-term commitment.

When the broader luxury market slows, this model holds up.

The Moment That Made the Shift Impossible to Ignore

The clearest signal came in Beijing.

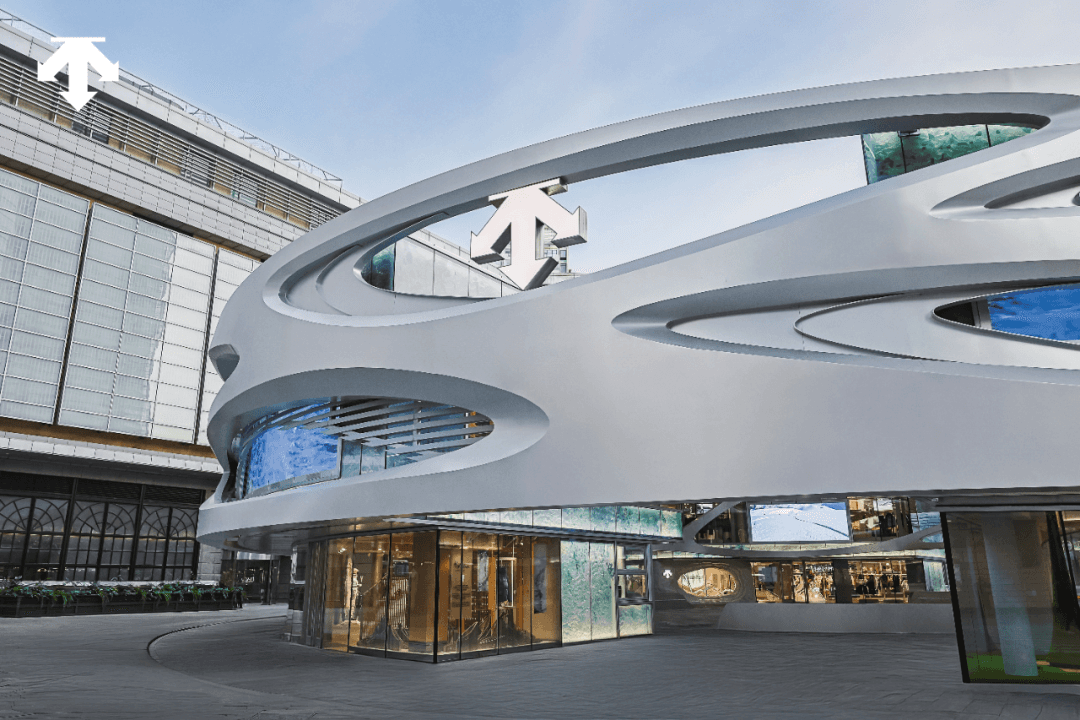

Descente opened its global flagship store, “City of the Future,” at China World Trade Center, right next to Beijing SKP. A 1,160-square-meter, ultra-premium space.

What makes this moment symbolic is what came before it.

That exact location was occupied for 17 years by Armani.

A traditional luxury heavyweight exited. A professional sportswear brand stepped in. And did so not quietly, but with one of the most ambitious flagship concepts in China.

This wasn’t a store opening. It was a handoff.

Why Descente Could Take Armani’s Place

Descente didn’t arrive by accident.

Its retail strategy follows a clear three-step playbook.

First, dominate professional environments.

Descente has deep roots in elite sports settings. It operates flagship stores at top-tier golf clubs like Shanghai Sheshan International Golf Club and partners with China’s most prestigious ski resorts, including Changbaishan and Yunding.

This isn’t mass exposure. It’s authority building.

Second, translate professionalism into urban lifestyle.

Once credibility is secured among elite users, Descente expands into premium city districts. Concept stores in Shanghai Xintiandi, Hangzhou in77, and Chengdu Taikoo Li bridge performance with culture, architecture, and art.

These spaces don’t sell gear. They sell a lifestyle grounded in discipline, movement, and long-term investment in the self.

Third, seal the premium perception with a global flagship.

“City of the Future” completes the loop. Located in one of China’s most commercially selective zones, its scale and design communicate that Descente isn’t adjacent to luxury. It’s competing on the same level.

What This Says About China’s High-End Consumer Today

This shift isn’t about fashion cycles. It’s structural.

After booming during the pandemic years, the global luxury market entered a downturn. Bain data shows the number of luxury consumers shrinking from 400 million in 2022 to around 340 million in 2025.

Flashy logo consumption is losing power. Price hikes without deeper value are being questioned.

Even Prada Group CEO Andrea Guerra has openly warned that constant price inflation erodes consumer trust.

Meanwhile, China’s sports economy is accelerating.

Under the country’s Five-Year Sports Development Plan, China’s sports industry is projected to reach 5 trillion yuan by 2025. With 2.8 trillion yuan coming directly from consumer spending. High-end sports like skiing and golf are growing faster than the market average.

Participation numbers are surging. Skiing surpassed 26 million participants in the 2024–2025 season. Running now reaches 118 million people nationwide. Even golf, long considered elite and inaccessible, is seeing steady youth participation growth.

These activities are no longer fringe hobbies. They’re becoming identity anchors for China’s new middle and upper-middle classes.

From Status Symbols to Value Systems

Here’s the key difference.

Luxury often sells aspiration. Professional sports sell discipline, progress, and belonging.

When consumers commit to sports like skiing, triathlon, or golf, they aren’t buying once. They’re investing long-term. In skills. In community. In self-definition.

Brands like Descente don’t just outfit these consumers. They support training, events, and physical spaces where communities form. Over time, the brand becomes part of how people see themselves.

That kind of value can’t be inflated overnight. It has to be earned through use.

The Real Takeaway

Descente replacing Armani in Beijing isn’t about sportswear beating luxury.

It’s about what premium means now.

China’s high-end consumers are becoming more rational, more experience-driven, and more focused on long-term value. They’re less impressed by logos. More interested in what a product does, how often it’s used, and what kind of life it supports.

In that world, professional sportswear isn’t a substitute for luxury.

It’s the next evolution of it.