This Chart Looks Optimistic. It’s Actually Kinda Terrifying.

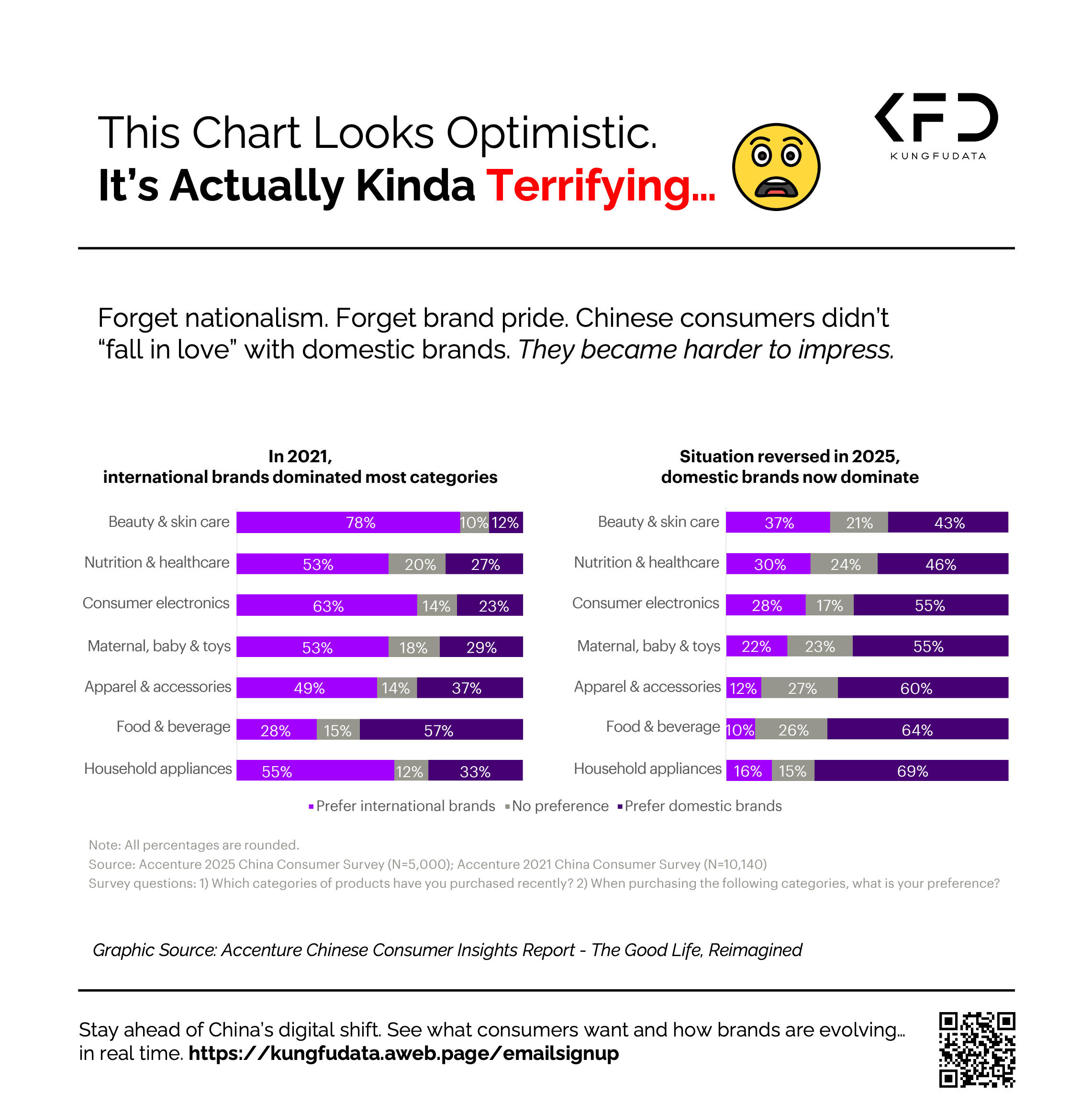

If you only glance at this chart, the takeaway seems obvious. China went from loving international brands in 2021 to overwhelmingly choosing domestic ones in 2025.

What really happened is more interesting, and more unsettling.

China didn’t just reshuffle brand preferences. It rewired how consumers think about value, risk, and necessity. And once that switch flipped, everyone started losing sleep, including the winners.

This Is Not a Nationalism Story

Yes, domestic brands are winning. But this is not a flag-waving, chest-thumping moment.

Chinese consumers didn’t wake up one day and decide foreign brands were bad. They decided something far more dangerous. Most brands are optional.

Consumers are now in full “considered consumption” mode. They ask sharper questions. Do I actually need this. Is the premium real or cosmetic. Can I find the same thing cheaper on another platform in 30 seconds.

Once consumers start thinking like this, brand equity becomes fragile. Even domestic brands feel it.

The Hidden Keyword Is 卷(Juan)

This chart is not about confidence. It is about pressure.

What we are seeing is 卷 (juan). An environment so competitive that everyone keeps accelerating just to stay in the same place.

Prices go down. Expectations go up. Margins evaporate.

Brands are forced to be excellent at everything simultaneously. Product, pricing, service, content, KOL strategy, livestreaming, logistics, CRM, private traffic. Miss one lever and the whole system breaks.

And here is the cruel part. Even if you do everything right, you still might not make money.

Why Domestic Brands Are “Winning” but Still Suffering

Domestic brands dominate these categories because they are built for chaos.

They move fast. They localize instinctively. They optimize funnels weekly, not quarterly. They understand platform algorithms like survival skills, not marketing tactics.

But conversion is harder than ever. Traffic is expensive and fickle. Promotions train consumers to wait. Loyalty is shallow.

So yes, domestic brands are taking share. But many are doing it with razor-thin margins and burnout-level execution.

Winning in a 卷 market does not feel like winning.

Why International Brands Are Struggling Even When They Are Good

International brands are not losing because they are irrelevant. They are losing because the old advantages no longer compensate for friction.

Global prestige does not offset price sensitivity. Slow adaptation does not survive algorithm-driven commerce. Beautiful storytelling collapses if the functional value is unclear.

In a market where consumers compare everything instantly, being “premium” is no longer a positioning. It is a claim that must be defended every single day.

The Real Takeaway No One Wants to Say Out Loud

This isn’t a story about China choosing local brands over global ones.

It’s a story about consumers choosing restraint over indulgence.

Less impulse. More calculation.

Less brand worship. More utility math.

Once that mindset sets in, it’s brutal for everyone.

If you’re operating in China right now and it feels harder than it used to, you’re not imagining it.

That’s not failure. That’s just 卷.